Check out our latest blog posts or browse by category.

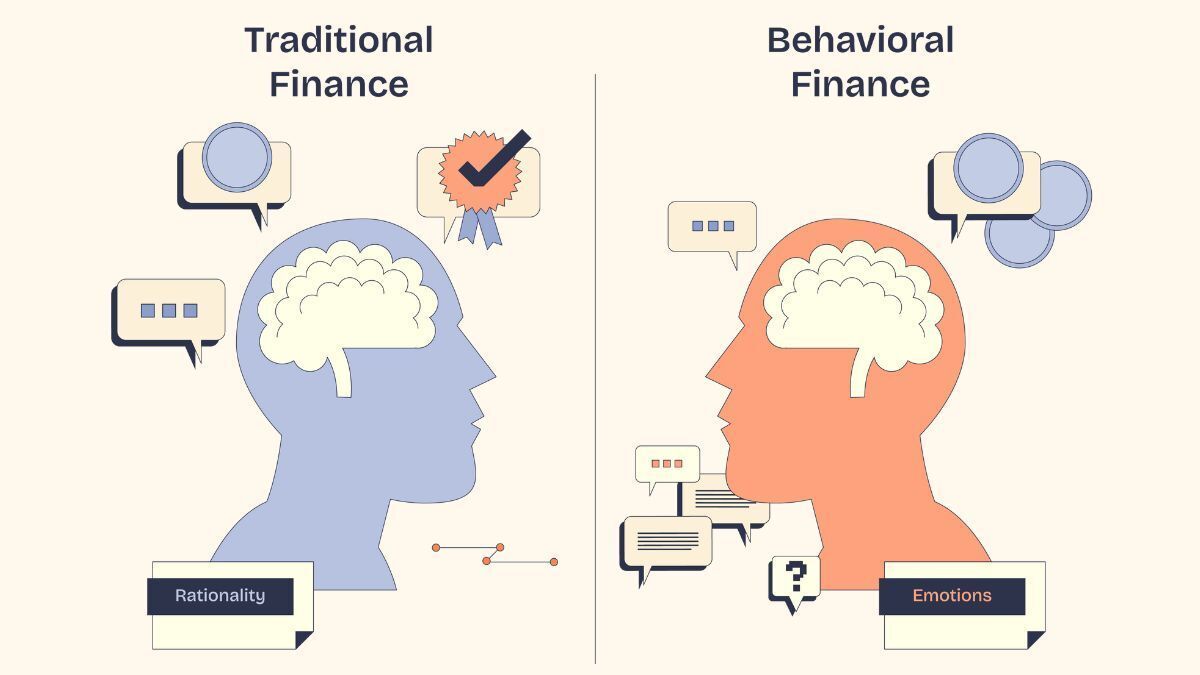

Emotions and behavioral biases often shape financial decisions more than we realize, influencing how we save, spend, and invest — especially during stressful times like tax season.

As we begin the year, reflecting on recent policy and market changes provides important context for the financial decisions and strategies that lie ahead.

Successful goal setting starts with clarity and simplicity. Using SMART goals, writing them down, sharing them for accountability, and celebrating small wins can help turn intentions into lasting habits. Making the process enjoyable keeps motivation strong and goals achievable all year long.

Receiving a bonus, inheritance, or income boost often sparks a key financial question: Is it smarter to pay off your mortgage or invest the extra cash?

As the year draws to a close, it’s a valuable time to pause, review your financial picture, and take steps to finish strong. This guide outlines practical, time-sensitive strategies to consider before the holiday rush sets in—covering tax-loss harvesting, Roth IRA conversions, charitable giving, catch-up retirement contributions, estate planning, and 529 education savings.

Inherited IRA Rules Have Changed

Starting in 2025, most non-spouse beneficiaries must take annual withdrawals and fully deplete inherited IRAs within 10 years. These rules can impact taxes and estate plans, making professional guidance essential.

April marks a big moment for college-bound families. From financial aid letters to 529 plan withdrawals, it’s time to balance dreams with financial reality.

Professional Financial Advisors is thrilled to announce Brad Hisel as the Head of Business Development. With nearly a decade of experience in the industry, Brad is poised to make a significant impact on our team and our clients.