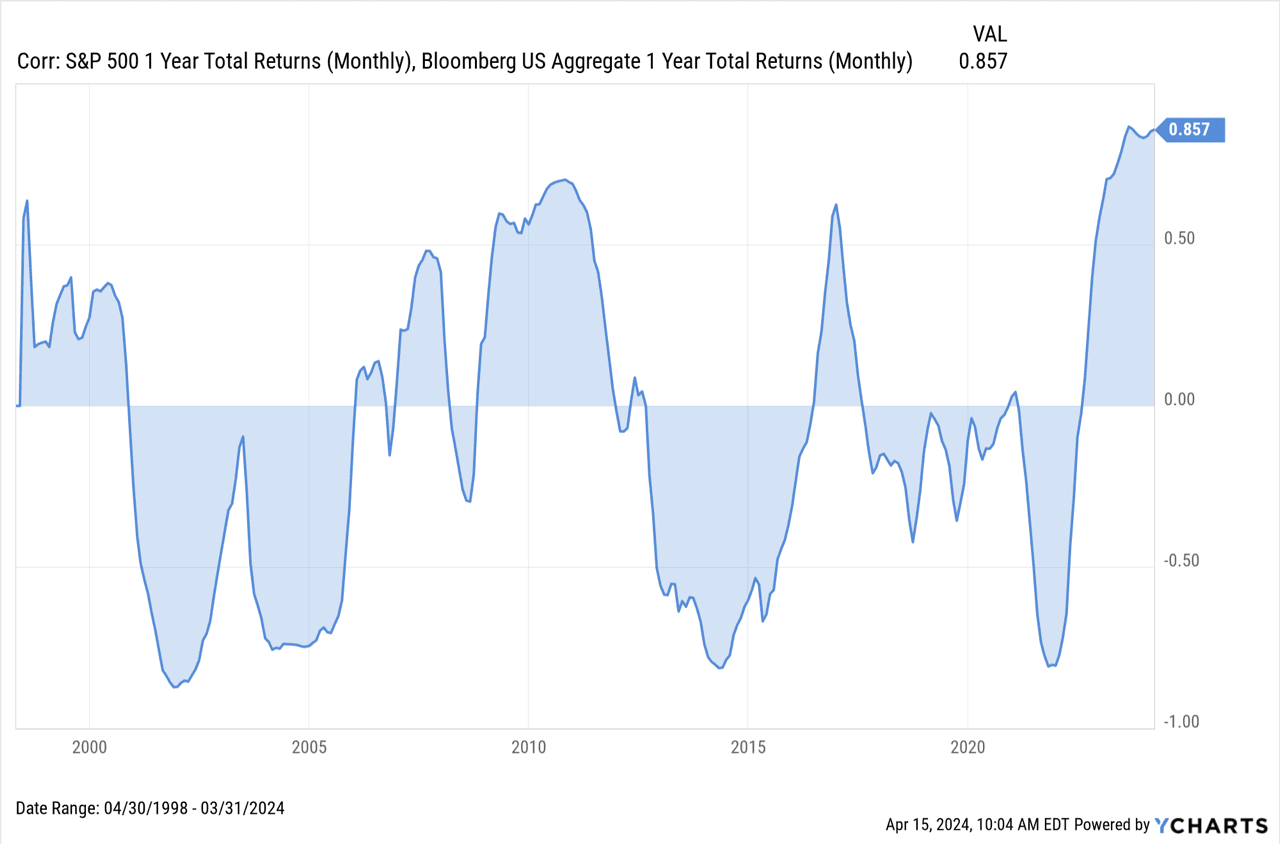

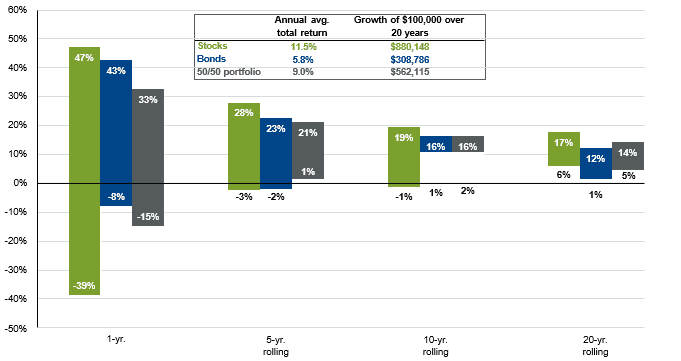

Recent trends show stocks and bonds moving in the same direction, challenging the traditional diversification strategy that relies on their negative correlation. This shift began in 2022 due to the Federal Reserve's interest rate hikes and economic concerns, impacting both asset classes similarly. While some view this positive correlation as a return to historical norms, the principle of diversification remains important, though it may require adaptation to current economic conditions.

Municipal bonds are issued by public entities such as state and local governments, health systems, universities, and school districts to help finance the building and maintenance of infrastructure projects such as roads, airports, water systems, and facilities. The interest paid by municipal bonds is generally exempt from federal income tax, as well as from state and local taxes if the investor lives in the state where the bond was issued.

Read about the valuable opportunity for those age 50 and over who are still working to super-charge their retirement savings and manage their income tax liability. Catch-up contributions offer the chance to invest additional amounts over and above the standard annual limits in IRAs and workplace retirement plans. Discuss the tax benefits associated with traditional IRAs and Roth accounts, as well as the potential penalties for distributions prior to age 59 1/2.

This blog post explores the power of dividends in a portfolio and why investors are increasingly turning to them as an income-producing investment. It discusses how dividend payments have represented roughly one-third of the total return on the Standard & Poor's 500 stock index since 1926 and why reinvesting dividends can lead to even more dramatic returns. Learn about corporate incentive to pay dividends, the differences among dividends, and the tax implications of dividend payments. Whether you're looking to maximize the returns of your investments or add income to your portfolio, dividends may be worth considering.

This blog post provides an overview of how the Federal Reserve's adjustment of the federal funds rate can affect consumers and investors. Learn how the federal funds rate, prime rate, and other interest rates can fluctuate, and how these changes can affect different types of investments. Discover the implications of the Fed's monetary policies and how to maintain a long-term perspective when making investment decisions.

This article dives into the merits and drawbacks of both lump-sum investing and periodic investing, otherwise known as dollar-cost averaging. Learn the different risks and benefits of each approach and how to make an informed decision that best suits your personality and circumstances.

This blog post explores the importance of holding equities for the long term, and the strategies that can help you remain disciplined and protect yourself from market volatility. Warren Buffett's words of wisdom remind us that sometimes the best move is to stay put and ride out the storm, while having cash on hand and an understanding of why you own certain stocks can help you make smart decisions. Read on to learn how to craft an approach that works for you.

Many Americans' moving towards retirement explore annuities, which is an investment strategy that is issued by an insurance company and designed to help protect you from the risk of outliving your income. Some annuity products can be particularly enticing for individuals who want guaranteed income benefits. These payments may start immediately or at a later time, depending on the stage of life you're in. An investor should conduct their own research to ensure they know what they are buying and understand the annuity contract's fine print, terms, and fees.

Owning a home outright is a dream that many Americans share. Having a mortgage can be a huge burden, and paying it off may be the first item on your financial to-do list. Deciding between prepaying your mortgage and investing your extra cash isn't easy, because each option has advantages and disadvantages. But you can start by weighing what you'll gain financially by choosing one option against what you'll give up. In economic terms, this is known as evaluating the opportunity cost.

When you buy cryptocurrency, you are engaging in something close to pure speculation — the possibility that another investor might consider the digital asset more valuable in the future even if there is no underlying value. Some investors may look at the extreme volatility of cryptocurrency as an opportunity to make quick profits by buying low and selling high, but this requires timing a market sector that is very difficult to predict, and the risks are extremely high. Considering all these factors, it should be clear that adding cryptocurrency to your portfolio involves adding volatility and risk in return for an unknown potential for gain. This kind of trade-off is not appropriate for all investors.

Referred to as the “investor fear index” or just the “fear gauge,” the VIX is the ticker symbol for the Chicago Board Options Exchange Volatility Index, which shows the market's expected volatility. The VIX is calculated daily, using the price of options on the S&P 500 and estimates how volatile those options will be between the current date and the option’s expiration date.

We went LIVE to discuss investment options and long term strategies. We also discussed updates on the Paycheck Protection Program...

How this late-winter, coronavirus-induced market turbulence affects you depends upon how old you are...

The odds of winning the lottery are astronomically long. Yet, the allure of pocketing hundreds of millions of dollars can tempt even the staunchest penny pincher...

The two dominant philosophies of asset allocating assets are strategic and tactical...

There have been significant changes made in the way Americans save for retirement since the enactment of the Tax Reform Act of 1986...

The window of time to make an IRA contribution is from January 1 of the tax year through the following year’s tax-filing deadline...

This isn’t your father’s stock index. But it probably is your grandfather’s...

One of America’s foremost thinkers, Benjamin Franklin, stated that “an investment in knowledge pays the best interest.” For individuals beginning to develop an investment strategy, no truer words may have been spoken...